The Biden administration released a report claiming Bitcoin is bad for the environment and ...

The Biden administration released a report claiming Bitcoin is bad for the environment and ...

Bitcoin in space!? Sounds pretty cool.

Jason Lowery (you can find him on Twitter by clicking here)...

The Securities and Exchange Commission (SEC) poses one of the greatest threats to Bitcoin and...

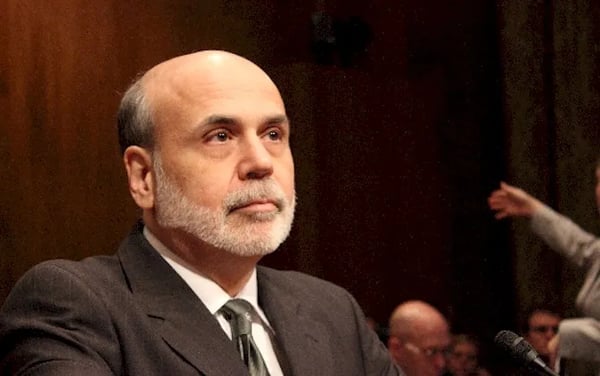

The Federal Reserve is no fan of bitcoin or digital assets.

This Is The Biggest Bitcoin Adoption Signal Of 2022

Ultimately, Bitcoin's adoption hinges upon institutions, governments, and banks integrating BTC into their systems and financial planning... and this $10 trillion+ institution may accelerate Bitcoin's adoption on Wall Street faster than expected.

BlackRock is an investment management company with over $10 trillion assets under management (AUM).

These assets range from real estate, stocks, bonds, foreign equities, and much more. However, the company has largely left the world of cryptocurrencies untouched... until now.

BlackRock is launching a private Bitcoin trust for their institutional investors.

Their public statement makes it sound as if the decision wasn't entirely their decision but more so pressure from investors.

"We are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities." - BlackRock statement.

BlackRock's reluctance isn't new. J.P. Morgan's CEO, Jamie Diamond, was also skeptical of Bitcoin before his company began offering services related to cryptoassets.

You can read more of BlackRock's statement here:

Bitcoin is the oldest, largest, and most liquid cryptoasset, and is currently the primary subject of interest from our clients within the cryptoasset space. Excluding stablecoins, bitcoin maintains close to 50 percent of the industry’s market capitalization.

BlackRock is encouraged that organizations such as RMI and Energy Web are developing programs to bring greater transparency to sustainable energy usage in bitcoin mining, and will follow progress around those initiatives...

BlackRock recently announced a partnership with Coinbase that will provide common clients of Aladdin and Coinbase access to the digital assets trading lifecycle through connectivity between Coinbase and the Aladdin platform, starting with bitcoin. Leveraging Coinbase’s comprehensive trading, custody, prime brokerage and reporting capabilities, common clients will be able to manage their bitcoin exposures alongside their public and private investments. - Blackrock statement.

This announcement is being made while the price of Bitcoin is roughly 70% off of its all-time high last November.

This means BlackRock must have investors demanding exposure to the asset while they perceive it to be a buying opportunity.

Powerful players such as BlackRock investing in Bitcoin is a bullish sign for Bitcoiners and crypto investors. This announcement may also act as a domino effect on Wall Street and encourage other firms to explore the world of Bitcoin.

BlockRock's move is a pivotal moment for Bitcoin in 2022.

The Crypto Christian Team